Table of Content

The government is considering changes to the Insolvency and Bankruptcy Code to speed up the resolution process, said a senior government official. Indians are emotional about certain financial goals, especially when these relate to children. Given a choice, no parent would want to burden their children with a loan, especially for the purpose of education.

So, you should pro-actively decide the tenure of the loan as per your capability. Having too many ongoing loans will not only impact your personal finances but also your repayment capacity. Hence, it is advised to clear the ongoing loans, if any, before you apply for a housing loan. Our EMI calculator helps you calculate the amount you have to pay the bank every month. Input your loan amount, tenure, interest rate, and processing fee to get your EMI and loan amortisation details. Bank of Maharshatra’s home loan has the lowest interest rate in India and no processing fee, making it the cheapest home loan.

When can I make a home loan application?

However, this benefit will be offered as per the discretion of your lender. For example, HDFC Bank offers the ‘Home Conversion Loan’ feature which can be used to transfer the existing loan to buy a new property. In addition to that, you can also get additional fund for the new property as per your home loan eligibility.

In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded. “Salaried profiles within age group of years and self-employed professionals and business class profiles within age group of years are best suited for long tenure loans. Most lenders offer Home Loans for a maximum period of 15 years depending on your repayment capacity, profession, etc. But that is not restricted as it depends on the lender only, they can even extend it up to 20 years depending on the profile.

How much tax rebate can one get by taking a home loan?

The process was good hence they have sanctioned the loan within 20 days. My home loan was taken from LIC Housing because their processing time and charges are less but interest rate is little bit high when i compared to other Government banks. Marginal Cost of funds-based Lending Rate is the benchmark rate set by a lending institution below which they cannot provide loans to their customers. Usually, it takes 3 to 4 weeks to get home loan sanctioned. However, you need to keep a few factors in mind for a better understanding.

Home Loan EMI should be 50% of net household take home salary. If your spouse is also working and assuming both are drawing equal salary then you may consider 100% of your take home salary as EMI i.e. 50% of net household take home salary. You should increase your Home Loan EMI every year after you get annual salary increment. This adjustment should ensure that your EMI is 50% of net take home salary. In many cases, i observed that after few years EMI is just 30% of net take home salary due to an increase in salary. A common justification is that we will save and then prepay at the end of the year.

Age limit for Home Loan

This means an enhanced loan amount eligibility and smaller EMIs. An NRI who lives abroad and files his/her income tax returns in India can get a tax deduction on interest paid and repayment of his/ her home loan. NRIs can get up to Rs. 1.5 lakh deduction on repayment of principal under Section 80 of IT Act and up to Rs. 2 lakh on interest paid for a home loan. Home loan interest rates offered by top banks for NRIs are listed in the table. Here’s another factor to consider if one is selecting a long term loan. Your commitment would last for a very long time, probably your entire earning career and beyond, especially if you are not in a situation to prepay your loan.

However, the co-applicants need not necessarily be the co-owner of the concerned property. Does having a personal loan affect home loan eligibility? However, other ongoing loans ultimately tend to affect your eligibility as your overall spending power is reduced.

Our commitment to nation-building is complete & comprehensive. SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI. As an NRI, you can repay your home loan normally using your NRE and NRO accounts. With lower EMI’s, that much less is the outflow and one may consider it to mange household budget better. If the tenure is more, lower will be the outflows in terms of EMIs.

Now assuming you bought a property for 50 lacs and paid interest of 35 lacs then your cost of the property is 85 lacs instead of 50 lacs. The higher cost of property means lower ROI from the property. I explained it in detail in my post, 5 Disadvantages of Home Loan. Therefore, i always caution my clients who buy property on Home Loan for investment purpose.

While taking a home loan from a bank or any other lender, amongst other important things, one has to decide the tenure of the loan i.e. the repayment period. As these accounts would be used for the repayment of the loan. As per the RBI guidelines, the repayment of these loans can only be through a NRE or a NRO account with remittance from abroad. No other funds can be used for repayment and that too be in Indian currency only. I took home loan from MAGMA HOUSING FINANCE on 6 months back , the loan duration of 20 years for the amount of 18L. From LIC, they offered a home loan and the loan amount was Rs. 27,00,000.

However, this is not in the best interest of the borrower. Any extension in EMI increases your overall interest payable amount. You can easily save this by asking your lender to keep the tenure intact as you are ready to pay higher EMIs.

Kotak Mahindra offers a competitive interest rate and is a growing bank in India, though the processing fee for self-employed is 1% but the other parameters are still competitive. Can I get a higher loan through my existing loan account to buy a new property? Yes, you can use your existing loan account to purchase a new property.

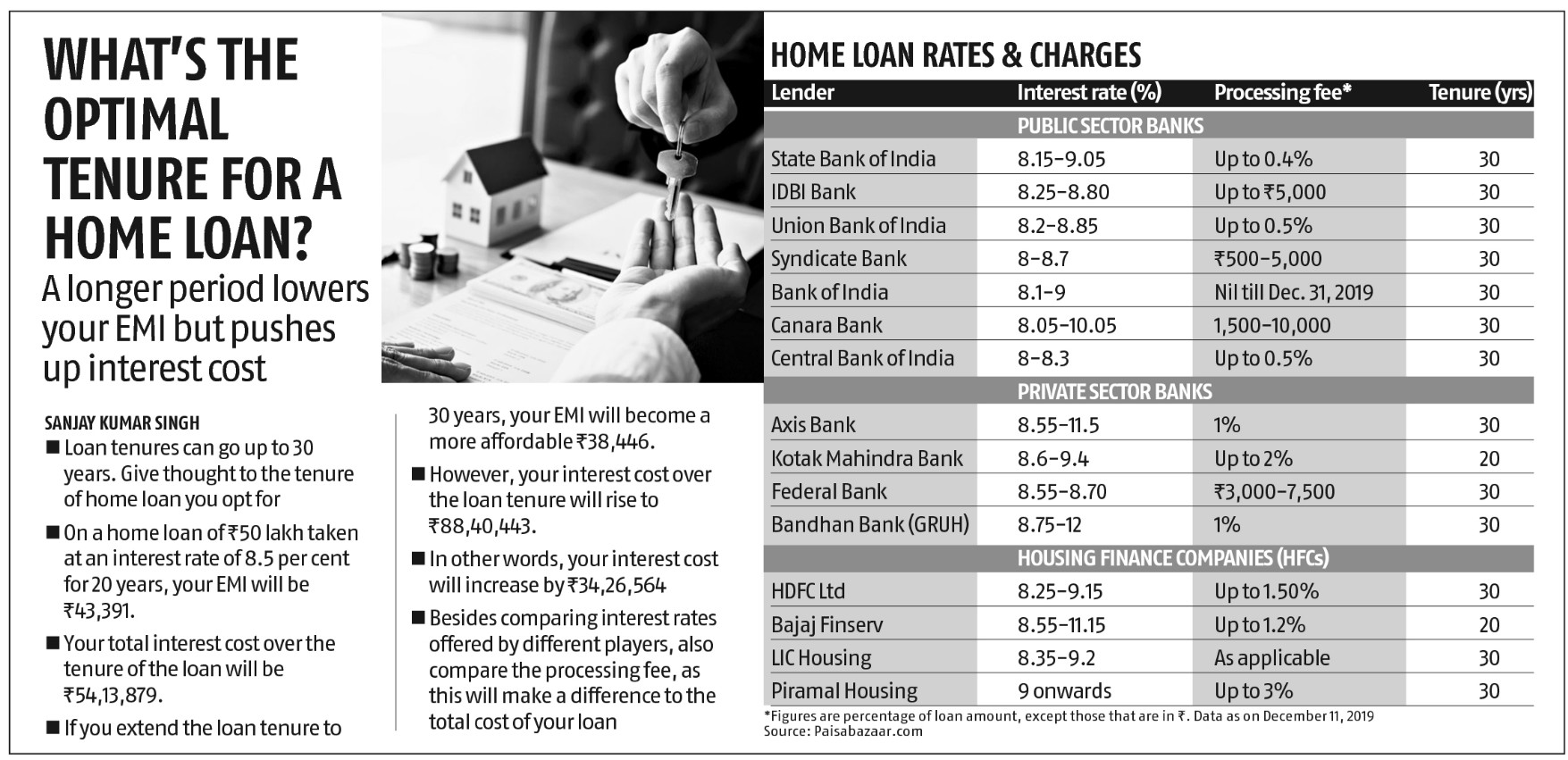

If he increases the EMI every year by 5%, the loan gets paid off in less than 12 years. If he tightens the belt and increases the EMI by 10% every year, he would pay off the loan in just nine years and three months. The maximum home loan tenure offered by all major lenders is 30 years. The longer the tenure, the lower is the EMI, which makes it very tempting to go for a year loan. However, it is best to take a loan for the shortest tenure you can afford. In a long-term loan, the interest outgo is too high.

In the post-pandemic era, the Indian government has made it easier for people to avail of home loans at an attractive interest rate. Most banks will allow a maximum of 30 years of home loan tenure in 2022. The average age of service retirement is considered 58 years and hence if you’re a 28-year-old, you can avail yourself of the full home loan tenure of 30 years. If you need any help in availing yourself of a home loan, you must consult the real estate and home loan experts at NoBroker. If interested, please leave a comment below this article; our executive will be in touch with you soon.

No comments:

Post a Comment